GST number check is a simple way to find any business’s tax details using its GSTIN (Goods and Services Tax Identification Number). If you ever got a bill and want to know if it’s from a real GST-registered business, you can do a quick GST number check online. It helps you know if the GST number is real or fake. This process is very helpful for shop owners, customers, and businesses who want to stay safe from fraud and ensure correct tax details. The best part is, you don’t need to be an expert — anyone can do a GST number check using their phone or computer in just a few steps.

When you do a GST number check, you can see full information about the business like its name, address, registration type, and the date it was added to the GST system. It’s a smart and easy way to confirm that the business you are dealing with is genuine. Whether you are a buyer checking a shop’s invoice or a business verifying your partner’s GST details, this tool is free and open to all on the official GST portal. In this blog, we’ll guide you on how to do GST number check online, what details you can find, and why it’s important for everyone in India who pays or collects GST.

What Is GST Number and Why GST Number Check Is Important

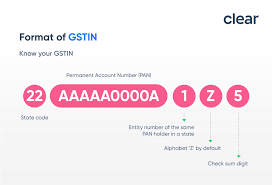

A GST number, also called a GSTIN (Goods and Services Tax Identification Number), is a unique 15-digit code given to every business registered under GST in India. This number helps the government track taxes on goods and services. When you do a GST number check, you can confirm if the business you are dealing with is real or not. It helps you avoid fake bills and wrong tax charges.

For example, if you buy something from a shop or online store and see a GST number on your bill, you can do a quick GST number check to see if it’s genuine. This simple check keeps you safe from fraud and also ensures you are paying tax to a real business that follows Indian tax laws.

Step-by-Step Guide to Do GST Number Check Online

Doing a GST number check is very easy. You don’t need to visit any office or use a paid app. The official GST website offers a free tool for everyone. Follow these simple steps:

- Go to the official GST portal: https://www.gst.gov.in/

- On the home page, look for the “Search Taxpayer” option.

- Click on it and select “Search by GSTIN/UIN.”

- Type the 15-digit GST number you want to check.

- Enter the captcha code shown on the screen.

- Click the “Search” button.

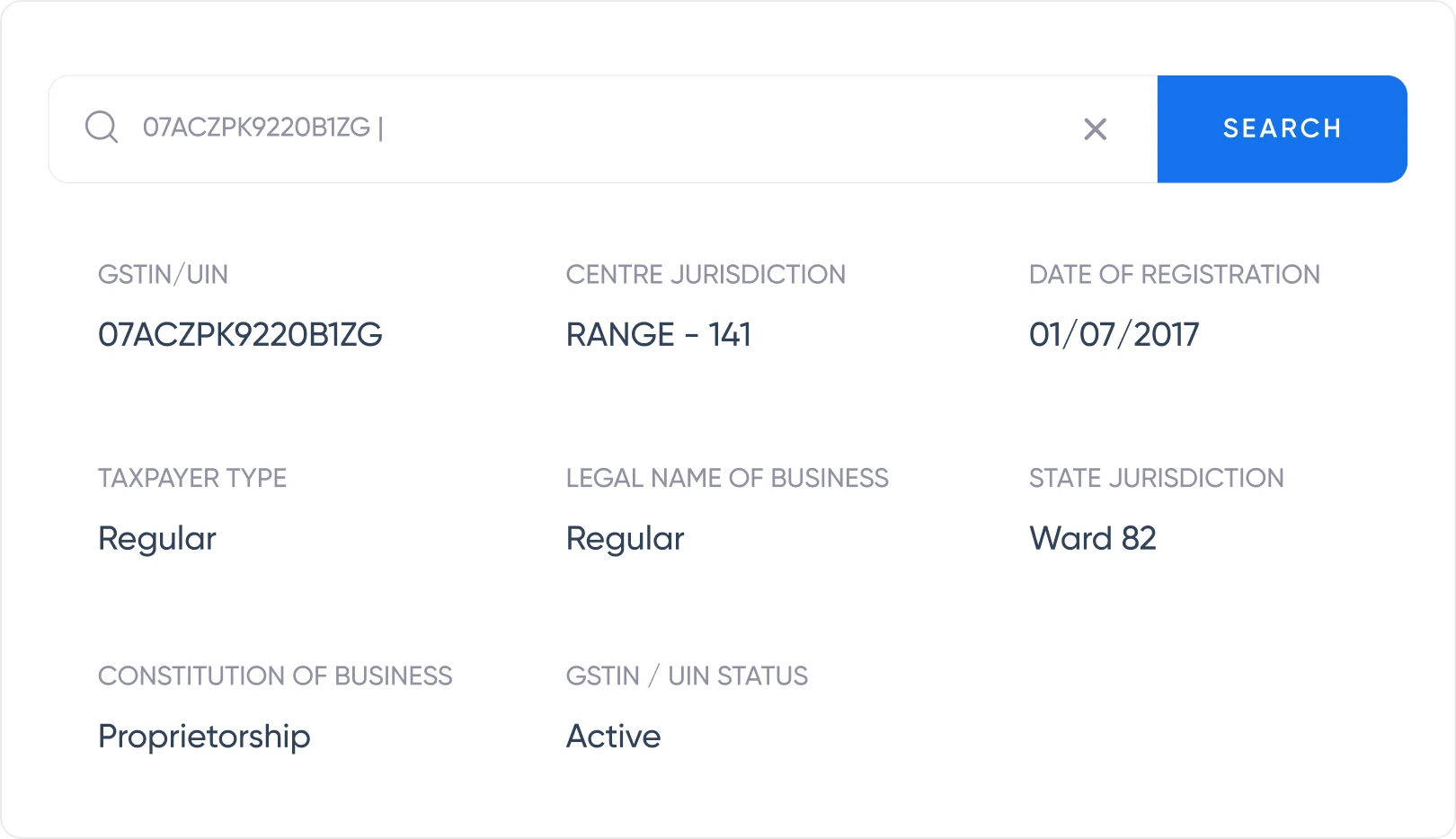

Once you click search, you’ll see all the details about that GST number — such as the business name, state, registration date, and type of taxpayer.

How to Verify GST Number Using the Official GST Portal

The official GST portal is the safest place for doing a GST number check. It’s managed by the Government of India, so all information shown there is 100% correct. If a GST number is fake, the system will show “No record found.”

By using the GST portal, you can also check if a business is active or cancelled. Sometimes, businesses close or their registration gets cancelled. So, if you see “Cancelled” in the status, it means that the business can no longer charge GST. Checking this helps you deal only with active and registered businesses.

Easy Way to Find Business Details Through GST Number Check

When you do a GST number check, you get more than just the business name. You can also see other useful details like:

- Legal name of the business

- Trade name (if different)

- State and district of registration

- Date of registration

- Type of taxpayer (Regular, Composition, etc.)

- Business constitution (Individual, Partnership, Company, etc.)

- GST return filing status

These details help you know if the business is genuine and if they are following GST rules properly.

How to Do GST Number Check by PAN or Business Name

If you don’t have the GST number but still want to check, you can search by PAN (Permanent Account Number) or business name.

Here’s how:

- Go to the GST portal and click on “Search Taxpayer.”

- Select “Search by PAN.”

- Enter the business PAN number and captcha code.

- Click “Search.”

You’ll get a list of all GST numbers linked to that PAN. You can then click on each one to see details. This is very useful for people who work with multiple vendors or suppliers.

Benefits of Doing GST Number Check for Customers and Business Owners

Both customers and business owners can benefit from GST number check.

For customers:

- It helps you confirm the business is genuine.

- You can ensure you are not paying fake GST.

- You can report any fake GST numbers to authorities.

For business owners:

- You can verify your suppliers or clients before working with them.

- Helps in maintaining clean tax records.

- Avoids fraud and fake invoice issues.

In short, GST number check keeps both buyers and sellers safe.

Common Errors People Make During GST Number Check and How to Avoid Them

While checking GST numbers, people sometimes make mistakes. Here are some common ones:

- Typing the wrong GST number (even one wrong letter or number will show no results).

- Using fake websites instead of the official GST portal.

- Not checking if the GST number is active or cancelled.

To avoid these issues, always use the official site and double-check the number before searching.

Is GST Number Check Free for Everyone?

Yes, GST number check is totally free. You don’t need to pay any money or sign up on any website. The government has made it open for all to help people confirm the genuineness of GST-registered businesses.

If you see any website asking for money or login details, it’s fake. Only use www.gst.gov.in for checking GST numbers safely.

What Details You Get After Doing a GST Number Check

After you search for a GST number, you can see these details on the screen:

- Business name and type

- Registration date

- State and zone of registration

- Taxpayer type (Regular/Composition)

- GST return filing details

- Whether the business is active or cancelled

This full information helps you confirm everything before doing any business or paying GST.

Why You Should Always Verify GST Number Before Any Transaction

Checking the GST number before any business deal or purchase is a smart habit. It saves you from scams and wrong invoices. If you’re a buyer, it ensures you pay GST only to a real business. If you’re a seller, it keeps your records clean and helps you build trust with customers.

By doing this small step, you can avoid big problems later and help make the tax system fair for everyone.

Conclusion

Doing a gst number check is one of the simplest and smartest ways to stay safe in today’s digital business world. It only takes a minute but helps you confirm that a company or seller is genuine and legally registered under GST. Whether you’re a customer checking your bill or a business owner verifying a client, always do a quick GST number check before making any deal. It helps build trust, prevent fraud, and support a transparent tax system in India.

FAQs

Q1. What is the full form of GSTIN?

GSTIN stands for Goods and Services Tax Identification Number. It’s a 15-digit code given to every GST-registered business in India.

Q2. Can I do GST number check for free?

Yes, GST number check is completely free on the official GST portal.

Q3. What if I find a fake GST number on a bill?

If a GST number is fake or invalid, report it to the GST department or file a complaint on the official portal.